Buying a home can seem daunting, especially the first time, but owning property remains the greatest driver of generational wealth and eligible veterans are afforded certain benefits to make owning a home easier through the VA Home Loan Program.

Veterans, reservists and National Guard members can purchase a home or refinance an existing loan – whether it’s a VA loan or not – with no down payment.

“The no-down-payment piece is certainly the signature benefit,” said Chris Birk — vice president of mortgage insight at Veterans United, a Columbia, Missouri-based mortgage lender that specializes in VA loans. “It has been since the benefit’s inception.”

VA home loans are also exempt from private mortgage insurance (PMI), which lenders tack on as a monthly fee for conventional loans with a down payment of less than 20%. On average, that saves veterans $30 to $70 per month for every $100,000 of home value.

“That’s a huge savings,” said Terry Rouch — a Navy and Coast Guard Auxiliary veteran with three decades of experience in the home-loan business, who currently serves as the assistant director of loan policy and valuation for the Loan Guaranty Service of the Veteran Benefits Administration. “That’s what drives the whole program is literally the ability to buy a home without putting a down payment on that property. That’s why, since World War II, millions have used that.”

National Guard and Reserve members may qualify for a VA home loan if they:

- Served at least six years and were honorably discharged or retired;

- Served for 90 days or more on active duty, including at least 30 consecutive days;

- Were discharged or released from duty for a service-connected disability.

Changes to Title 32 signed into law in January 2021 made the VA loan program available to some Guard members or reservists who were previously ineligible, so it doesn’t hurt to check even if you’ve been denied eligibility in the past.

RELATED: New legislation impacts guardsmen and reservists, their families

“It (changes to the law) opened up the aperture for thousands of new veterans that can purchase homes or refinance,” Rouch said.

There is no minimum credit score required for a VA loan, though most lenders require a score of 620 or higher, and there is no limit on the amount a veteran can borrow, though the average home purchase with a VA loan is roughly $310,000, according to Rouch.

Here are some other tips, if you’re considering using the VA Home Loan Program:

Do work with people you trust

Especially for first-time homebuyers, working with a lender and real estate agent can make the process much smoother. Finding a lender — credit unions, banks and mortgage lenders — and real estate agent who has experience with VA loans can be especially helpful in gathering paperwork for the pre-qualification process, which is critical in a tight and competitive housing market.

“They can really elevate the transaction,” Birk said.

Make sure your credit isn’t frozen and consider working with a lender to repair any blemishes months before trying to buy a home. It can help you secure a better rate and save money in the long run.

Be prepared to document your income and assets, and avoid making any other big purchases — like a new vehicle — or racking up credit-card debt.

Do shop around for the best rate

Not all mortgage lenders are created equal, so Birk recommends getting pre-qualified with multiple lenders, which allows the homebuyer to shop for the best interest rate and compare the fee structure for things like title insurance, loan origination, underwriting and other costs.

Be careful about giving information to mortgage aggregation websites, like Lending Tree or Nerd Wallet, unless you want to get inundated with calls. You also might consider asking family and friends who already own a home about their lender and read reviews online.

“We hope that people will shop around a little bit,” Rouch said. “Lenders aren’t created equal.”

It isn’t necessary to obtain your Certificate of Eligibility (COE) before starting the home-buying process, though some lenders might require it.

“If they (veterans) have any questions on eligibility, they need to work with a lender to gather the documentation that they need and request a COE,” Rouch said. “They can do that right away, but I would not recommend that they try it alone. It’ll make the process a little smoother if they have the lender involved doing it on their behalf, because they’ll be able to walk that through.”

Do weigh all your options

VA home loans often offer a lower interest rate than a conventional 30-year mortgage, which can save veterans a lot money over the life of the loan.

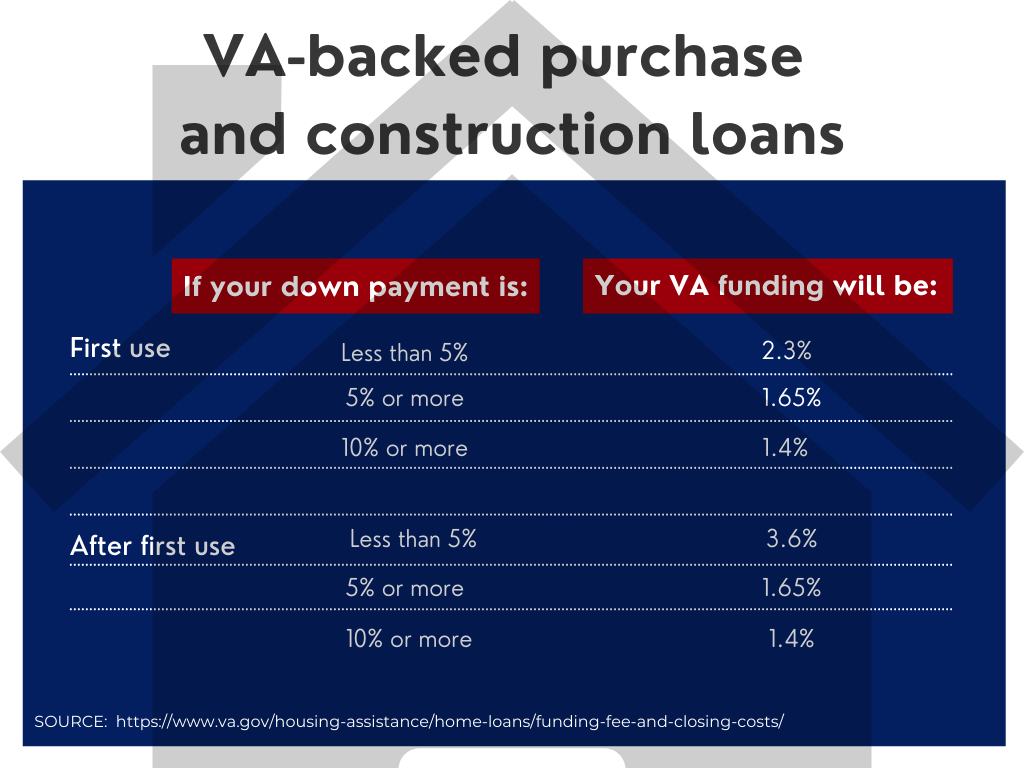

Through taxpayer dollars and the VA Funding Fee, which must be paid up front or rolled into the cost of a VA loan, the federal government partially guarantees VA loans against default.

“That ends up getting expressed through lower rates at the end of the day for consumers,” Birk said.

Veterans also can lower the VA Funding Fee with a down payment of 5% to 10%.

But there are some instances when a conventional loan or other option might make more sense. While a VA home loan is “arguably the most powerful option on the market” and a fantastic option for most veterans, it’s not right in every situation for every veteran, according to Birk.

That said, don’t let anyone talk you out of using your benefit, if you believe a VA home loan is your best option.

“We do see, from time to time, a lender or real estate agent pushing veterans toward non-VA options when the veteran really wants to use their benefit and feels that it is the best path for them,” Birk said.

Don’t forget to consider all home-ownership costs

As a homeowner, you’ll now be responsible for paying the annual property taxes — money that funds the local school district, fire and law enforcement departments, and municipal and county governments — as well as insurance yourself.

That money generally is paid in 12 monthly installments added to the monthly loan payment and held in an escrow account.

To save some money, be sure to rate shop for homeowner’s insurance, too. Many companies offer discounts for bundling home and auto policies, but it’s a good idea to get multiple quotes and reassess those policies every few years.

As a homeowner, it’s also important to remember that you are responsible for needed maintenance and repairs. A good rule of thumb is to expect to pay about 1% of the home’s value every year in upkeep for things like plumbing, heating and cooling, and other common household repairs.

Don’t get paralyzed by VA loan myths

There are plenty of myths about the VA loan process, which used to be more difficult for buyers and sellers. Some agents and lenders remain hesitant of VA loans, but the program has been improved and streamlined.

While there are slightly different Minimum Property Standards for a VA loan, it’s a myth that veterans can’t buy properties that need some fixing up.

Remember – those standards exist to prevent veterans from buying a flawed home with dangerous or unsafe conditions that will turn into a money pit after the closing.

It’s also a myth that VA loans require the seller to pay for more than a conventional loan, eating into any profit from the sale of the home.

“The appraisal process is no different for the most part,” Rouch said. “The only difference is we order the appraisal, meaning it’s a VA-approved appraiser that we schedule, versus a conventional loan, where they’ll go out to anybody and schedule the appraiser.”

In most cases, VA has made changes to ensure its appraisal process is less conservative and more timely than in the past.

Don’t get discouraged

During fiscal year 2021, which ended in September, VA closed a record 1.4 million loans, according to experts, despite soaring real estate prices. But a lot of prospective buyers lost out to cash offers or bidding wars.

Rather than fixate on one property, take a flexible approach to your home search with a list of necessities you need to be comfortable and content in a home and get a good handle on school districts in the area and access to amenities.

If you’re buying a starter home, it might not be in perfect condition, so you may have to put in some sweat equity.

If you’re moving to a new home, make sure not to overextend your finances or overpay for a property just because the market is hot.

Finally, remember that veterans, reservists and guardsmen can use the VA home loan program — with its zero-down payment option and PMI exemption — as often as needed to buy a home or refinance an existing loan, even if the original loan wasn’t a VA loan.

“If they’re upgrading, the VA home loan is still an option for them,” Rouch said. “A lot of veterans don’t realize that, but it’s not a one-time use. You can use the VA loan as many times as you want.”