It is tax time! Service members and military families are fortunate to have access to so many tax filing resources to help with the process, but before that you need to know a few things. Like, what documents are required, what are your rights as an employee or independent contractor, and of course, where can you file (for free in some cases)?

We put together some quick tax filing resources to help service members and their families expedite the process—and no, we cannot speed up how fast Uncle Sam sends you your refund.

Step one: The W-2s.

If you work for the Department of Defense as a uniformed service member or civilian, or if you are now a retiree, DFAS (Defense Finance and Accounting System) is responsible for releasing your 2018 tax statements. Below is the list of when the statements are released by branch, but you must have a login for myPay to access it.

The rundown of when tax statements are released by branch:

Retiree 1099-R – available now

Reserve Component Air Force, Army, Navy W2 – available now

Marine Corps Active & Reserve W-2 – available now

Army Non-Appropriated Fund (NAF) civilian W-2 – available now

Active Duty Army, Air Force, Navy W-2 – available Jan. 22

Military/Military Retiree IRS Form 1095 – available now

Civilian IRS Form 1095 – available Jan. 22

The full list can be found at the 2018 myPay Tax Statement Schedule.

Step two: Civilian tax documents.

If you have other sources of income, employers have until January 31, 2019 to send out W-2s, according to the Internal Revenue Service. Examples of other items you may need in order to file are college tuition statements, bank statements, receipts, and mortgage interest statements.

When in doubt, ask the professionals at Military OneSource (for free). Contact them at 800-342-9647.

Step three: Where can you file as a military member and military family (hopefully for free).

After you have gathered all of your tax documents, it is time to decide if you are going to file for yourself or use an external agency. Military ID card holders have a few options for free or discounted filing:

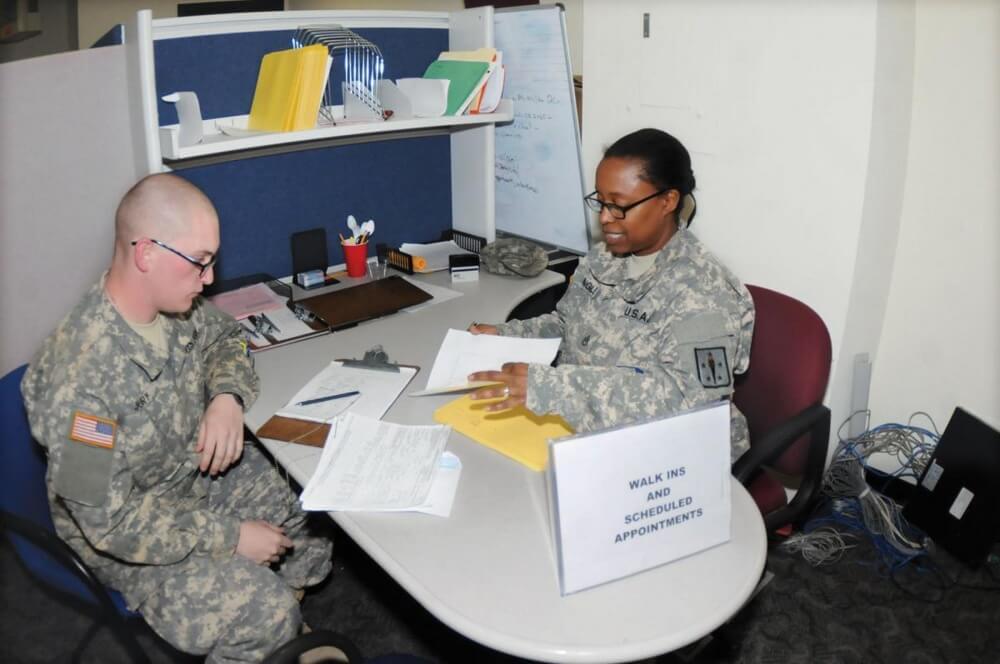

Installation tax centers: Look up your installation’s information by clicking here. In most cases you have the option to set an appointment or walk-in.

Military OneSource offers free tax filing support through its MilTax program. [We have personally used it and it is so easy to navigate]. In addition to the e-filing software, MOS also offers consultants who can assist you. Click here to learn more: MilTax.

Note: In order to utilize this service, you must first establish a free account with Military OneSource. Click here to get started.

IRS Free File – for any taxpayers with an income less than $66,000. Access free fillable forms after Jan. 28.

TurboTax – offers free federal and state tax filing for E1 – E5; discounted rates for E6 and above.

TaxSlayer – free federal filing for all military.

Make sure you file federal income taxes no later than April 15, 2019. In order to receive a six month extension, you must file this form.

Step four: When will you get your refund?

This is really the most important question, isn’t it? Despite the current government shutdown, the IRS confirms on its site that it will start processing tax returns on Jan. 28 and refunds will be issued on scheduled. Check back for updates.

Also, and we cannot stress this enough, as awesome as it is to receive a nice chunk of money, put some thought into what you plan to do with it. Installations around the US has personal finance counselors and Military One Source has representatives who you can speak with over the phone. We’re not saying you should hold off on planning that Disney getaway, just don’t have the full refund spent before it even hits your account.

Check out more tax tips from USAA: 5 Tax Tips for Service Members and Their Families